Nykaa is not giving up on fashion yet.

The listed beauty and personal care brand, primarily known for its beauty segment, has kept fashion on the back seat for a while. Until now.

Nykaa released its Q2 FY26 results and reported stellar performance with a 166% jump in its consolidated net profit to INR 33 Cr in the quarter under review, from INR 13 Cr in the same quarter last year.

Overall revenue surged 25% YoY and 9% QoQ to INR 2,346 Cr and there was a 53% YoY jump in EBITDA to INR 159 Cr (6.8% EBITDA Margin). And a bulk of this was due to the beauty segment. Fashion contributed less than 10% to the revenue this quarter, but its improving profitability could actually influence Nykaa’s stock and direction going forward.

Beauty Vs FashionFrom working on its private labels to introducing legacy brands on its platform, Nykaa is working on serving all segments of its customer base for both segments – beauty and fashion.

The beauty vertical, which has always been in the spotlight, reported a 25% jump in its YoY, but fashion revenue growth was relatively timid.

Q2 FY26 revenue grew 22% to INR 201 Cr from INR 166 Cr in FY25, but Nykaa was particularly keen to point out that adjusted EBITDA loss fell by almost 63% YoY and 55% QoQ to INR 12 Cr.

It will be interesting to see whether the market factors fashion into Nykaa’s price going forward, because thus far it was not a major factor within Nykaa’s overall revenue structure.

“Nykaa’s stock will be rallying after this quarters’ result. My guess is in the next coming quarters, there will be a significant interest from the market players to take up the company’s stock,” IIM Calcutta finance professor Sudhakara Reddy said, adding that December quarter earning per share is expected to jump 3x YoY to around INR 0.26 from INR 0.09 last year.

Reddy elaborated that this growth is on the back of both — strong top line and bottom line results. And fashion vertical’s improved margins are expected to be a big factor in this drive.

In a brokerage report at the end of October, JM Financial reportedly maintained a ‘buy’ rating on Nykaa, projecting around 28% year-on-year GMV growth. While Nykaa missed this guidance, there are signs of its diversified supply chain and sharp segmentation is showing results.

Nykaa’s Unwavering Trust In FashionNykaa founder and CEO Falguni Nayar called the uptick from -9% to -3.5% EBITDA margin in 2025 a huge improvement for the fashion vertical during the Q2 earnings call.

The vision is to make its fashion segment EBITDA break even by the end of FY26. After the Q1 results, Nykaa said that it is planning to grow itsfashion vertical by 3-4X in the next five years, on the back of product line expansion and new customer acquisition.

And while three months later, the segment continues to be in loss, Nykaa is gradually taking strides in the right direction, thanks to “structural interventions that we have made in the business over the last year”, according to Nykaa Fashion business head Abhijeet Dabas.

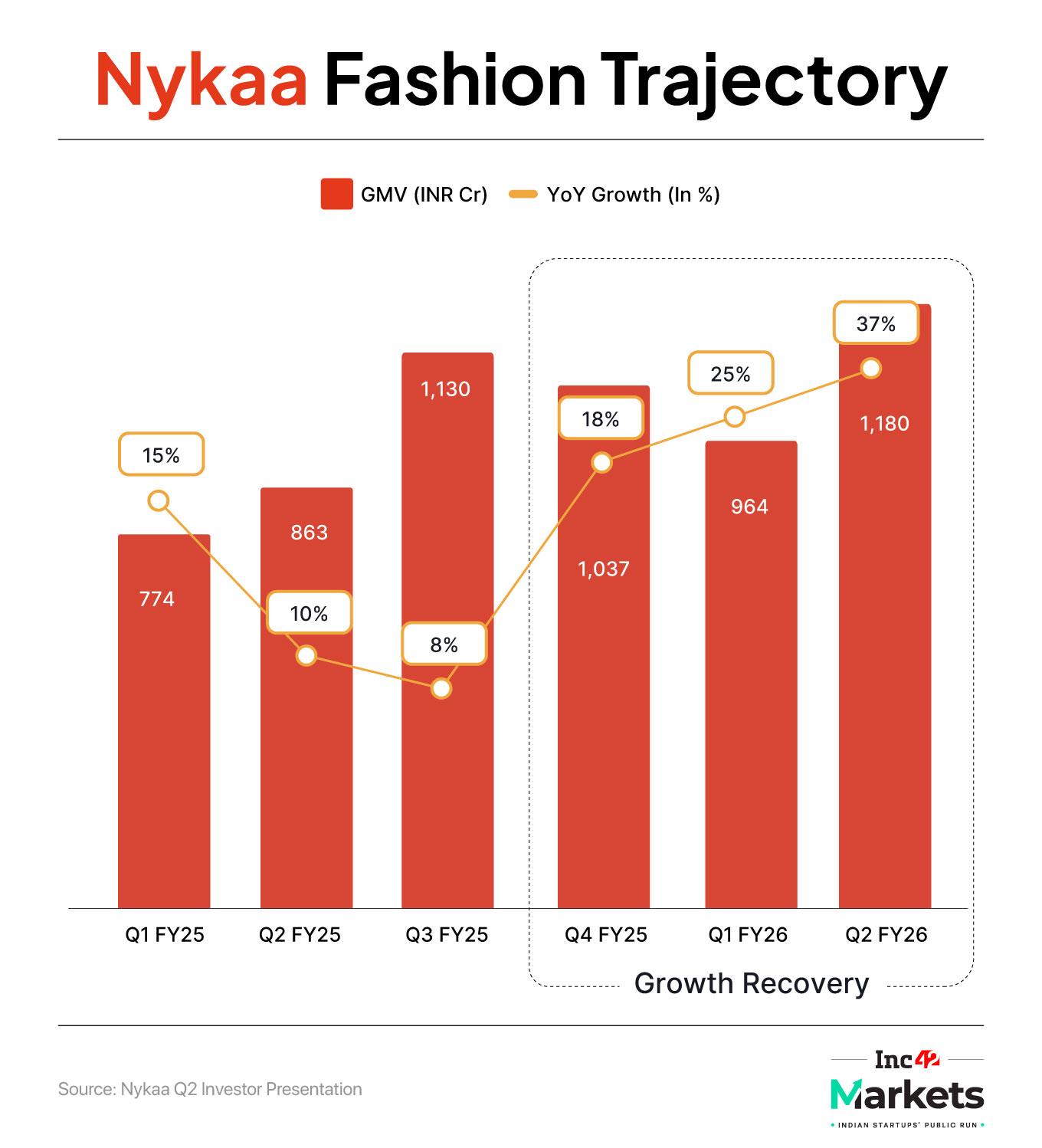

For the first time, GMV breached the INR 1,000 mark, which is a major landmark for the company. From INR 863 Cr in Q2 FY25, the segment reported INR 1,180 Cr in GMV for the quarter ending September.

Competing with more scaled up players like Myntra, Amazon Fashion, AJIO among others, Nykaa Fashion’s customer acquisition and retention strategy will be in focus going forward. It reported 191 Mn visits for fashion in the quarter, 30% up YoY.

Dabas also claimed that Nykaa Fashion managed to bring down its marketing expenses without disclosing the exact figures. But the reported improvements in the adjusted EBITDA show that the company is indeed figuring out some kind of operating leverage for fashion.

This will be key because it will feed Nykaa’s profit machine which is currently centred around beauty

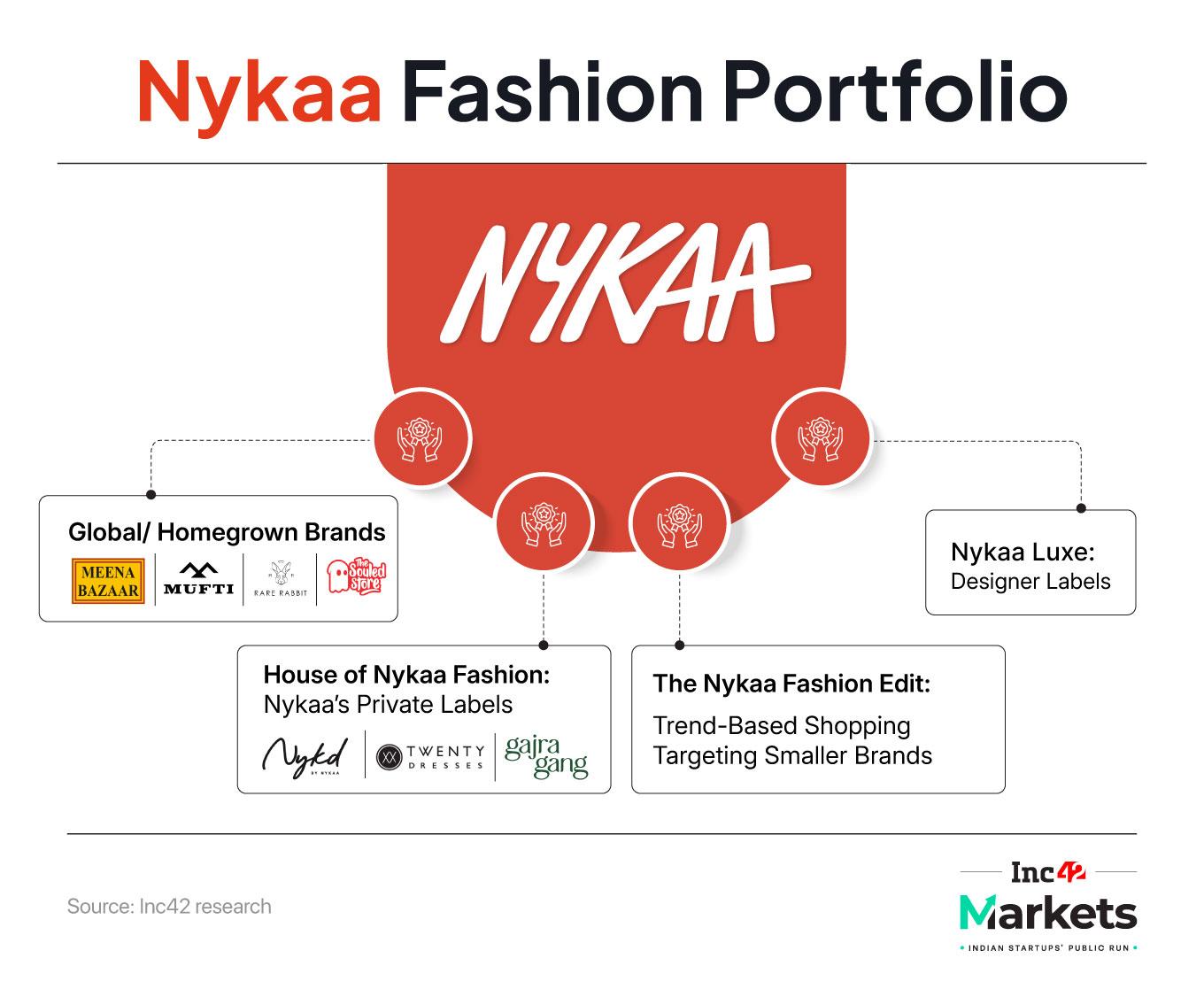

Following Beauty Footprints?Indeed there are some parallels between Nykaa’s strategy for fashion and beauty. From introducing private labels to collaborating with global brands, Nykaa Fashion is trying to replicate the beauty playbook.

Under Nykaa Fashion, the company is working on strengthening its private label brands including Nykd, Twenty Dresses, KICA, RSVP and Gajra Gang. This is similar to Nykaa banking on its private beauty brands like Nykaa cosmetics, Kay Beauty, Nykaa Perfumery etc.

As per the company, its lingerie brand Nykd by Nykaa’s annualised GMV crossed INR 175 Cr.

But building new fashion brands is increasingly harder in today’s environment, plus a lot of Nykaa’s beauty brands are acquired properties.

The company would do well to focus on acquiring smaller brands and growing the share of owned brands within its fashion marketplace. This would reduce some of the customer acquisition burden in the long run.

One could argue that Myntra has scaled up this particular strategy better than its rivals, with dozens of private labels across segments. The Flipkart-owned platform operates brands such as Roadster, HRX by Hrithik Roshan, Mast & Harbour, Dressberry, and Anouk.

Along with focusing on its own brand, Nykaa Fashion is also prioritising selling via its own platform and shutting down other distribution channels for fashion including general trade, modern trade, ecommerce marketplaces among others. This should ideally allow the fashion business to have a stronger hold on pricing, delivery quality and customer data.

“There has been a concerted strategy to shut down some of the non-Nykaa channels in fashion. We’ve been shutting down the GT/MT, large format store, third party distribution etc. We feel it’s better and higher quality business to focus on Nykaa as a channel for fashion in particular,” said Nykaa Fashion CEO Adwaita Nayar.

The fashion segment closed FY25 with GMV of INR 3,800 Cr, up 12% YoY, but it is exiting Q2 FY26 with GMV of INR 2,144 Cr (31% up YoY). The momentum is on Nykaa fashion’s side, but can it succeed in scaling up revenue while keeping its profitable trajectory intact?

Besides global and homegrown brands including The Souled Store, GAP, Meena Bazaar, Rare Rabbit and others, the fashion vertical is also bringing renowned global brands like Sweden-based clothing giant H&M and others.

It is also looking to bring smaller and newer brands with lower visibility on other marketplaces to tackle trend-based shopping waves, exactly like the Korean skincare craze that propelled Nykaa’s GenZ customer case.

It is fair to say that Nykaa is able to hold onto its fashion dream due to strong performance on the beauty front. The quarterly revenue of INR 2,132 Cr was close to the GMV of the fashion segment. So it wouldn’t be wrong to say that fashion is being propped up by Nykaa’s core strength.

Nykaa’s beauty business gained additional momentum as the company accelerated its offline expansion with 19 more stores added in the quarter. Additionally, Nykaa strengthened its quick commerce initiative, Nykaa Now with 53 rapid stores in 7 cities.

But any threat to the model from a shift towards new channels or rivals will be a blow not just for the beauty segment but also the fashion vertical.

This is why Nykaa’s private label business will have to bear more and more of the growth load. Close to INR 2,200 Cr came from in-house brands including Dot & Key, Kay Beauty, Earth Rhythm and Nykaa Cosmetics, and this particular number has to be pushed up significantly closer to the top line for Nykaa to extract more profits.

With Nykaa seeing some of its faith in fashion paying off, can it sustain this quarterly growth, or will its story unravel?

Markets Watch: New Issues, Financials & More- Pine Labs Off To Muted Start:Fintech firm Pine Labs’ IPO had a muted debut on its opening day, with subscriptions reaching just 0.13 times. The public issue received bids for 1.29 Cr shares against the 9.78 Cr shares on offer

- Groww Draws Massive Interest:Groww’s IPO ended on a high note, witnessing an impressive 17.6X oversubscription on the final day of bidding. The issue attracted bids for 641.86 Cr shares against the 36.48 Cr shares on offer.

- Swiggy’s Big Raise: Swiggy’s board has given the green light to raise INR 10,000 Cr (around $1.1 Bn) through a combination of public and private market issuances.

- PW Sets IPO Date: Edtech unicorn Physics Wallah (PW) has set its IPO price band at INR 103–109 per share, with the issue opening on November 11. At the upper end, PW will be valued at INR 31,169 Cr

- Delhivery’s New Turn:Delhivery is foraying into fintech as its board approved the incorporation of a new wholly owned subsidiary, Delhivery Financial Services with an initial investment of INR 12 Cr.

- Paytm’s Profit Shrinks:Fintech major Paytm remained profitable in Q2 FY26, though its PAT fell 98% YoY to INR 21 Cr, compared to INR 930 Cr in the same quarter last year, on the back of exceptional gains and loss.

That’s all for this week.

We’ll be back next Sunday with another edition of Inc42 Markets

Till then,

Palak Sharma

[Edited By Nikhil Subramaniam]

The post Nykaa Paves Beauty-Inspired Path For Fashion appeared first on Inc42 Media.

You may also like

Who is YourRAGE dating? Twitch streamer seen walking hand-in-hand with unidentified woman during NYC night out

Horror as two trains crash just 12 miles from capital city with dozens of casualties

Rahul, Tejashwi losing sleep over historic voter turnout in Bihar: BJP's Sanjay Jaiswal

350 kg explosives, 20 timers, Krinkov assault rifle seized: Faridabad Police Commissioner (Ld)

Pramod Tiwari takes dig at NDA, says Bihar elections are 'Biharis' vs 'Baharis'