Yet another EV startup is close to pulling its shutters down. Bengaluru-based three-wheeler EV manufacturer Altigreen has halted its manufacturing operations and is at risk of shutting down completely if it fails to secure funding.

Multiple sources familiar with the state of affairs at Altigreen told Inc42, a situation acknowledged by the company’s CEO, Amitabh Saran.

The Reliance-backed startup, which was one of the early moves in the three-wheeler EV manufacturing space, has been hit by a massive fund crunch. With dues mounting, the company is unable to sustain its manufacturing facility and has wound it down.

As per sources, the startup’s manufacturing plant in Malur near Bengaluru has been shut down, and the corporate office remains empty as employees have been told to work from home for the foreseeable future.

After the collapse of EV battery maker Log9, Altigreen’s crisis marks the second major flashpoint in India’s EV space, exposing the shaky foundations beneath many of the sector’s early bets.

Is this a result of the growing maturity in the EV ecosystem, with legacy players now doubling down on the category? Or is this just another startup that banked on VC money for growth without consistency in manufacturing and production quality?

Altigreen’s Many WoesInc42 spoke to several Altigreen’s dealers and learnt that while some of the dealers are still operational and offering servicing for the vehicles, several of them have stopped selling Altigreen products.

Employees say they have been more or less furloughed from the company in the interim, as the funding issues are being worked out.

“We have no work currently, as there is no manufacturing happening. Everything has come to a standstill. All we are waiting for is an instruction from the higher management,” said one person aware of the matter to Inc42.

Besides, Inc42 has learnt that the startup hasn’t paid its employee salaries since the beginning of the year. Several employees informed Inc42 that the 12-year-old startup had resorted to pay cuts in 2024, but that didn’t seem to have helped the situation.

As per sources, Altigreen’s senior management has informed the employees that they are going to receive funding next month and their salaries will be cleared. However, sources said that employees are likely to resort to legal action if their pending salaries are not cleared at the earliest.

So what happened to Altigreen, which had raised $40 Mn in its Series A, one of the biggest such rounds in the EV space and had backers like Reliance’s energy arm New Energy, Sixth Sense Ventures, Xponentia Capital and others?

How The Altigreen Story Began…Founded in 2013 by Amitabh Saran, Shalendra Gupta, Lasse Moklegaard, and John Bangura, Altigreen is an electric vehicle technology and solutions provider for commercial last-mile transportation through three-wheeled vehicles.

In the early years, Altigreen was primarily focussed on converting fossil fuel-driven commercial vehicles to hybrid electrics. The startup’s low-cost retrofit system, HyPixi, claimed to improve mileage by over 20% while cutting tailpipe emissions by 20% in both petrol and diesel vehicles.

However, later the startup ventured into manufacturing commercial vehicles, primarily focussing on the three-wheeler category. In the early years, the startup showed promise by receiving major orders. Banking on it, the startup managed to raise $40 Mn in funding in its Series A funding round led by Sixth Sense Ventures, Xponentia Capital, Accurant International and Momentum Venture Capital.

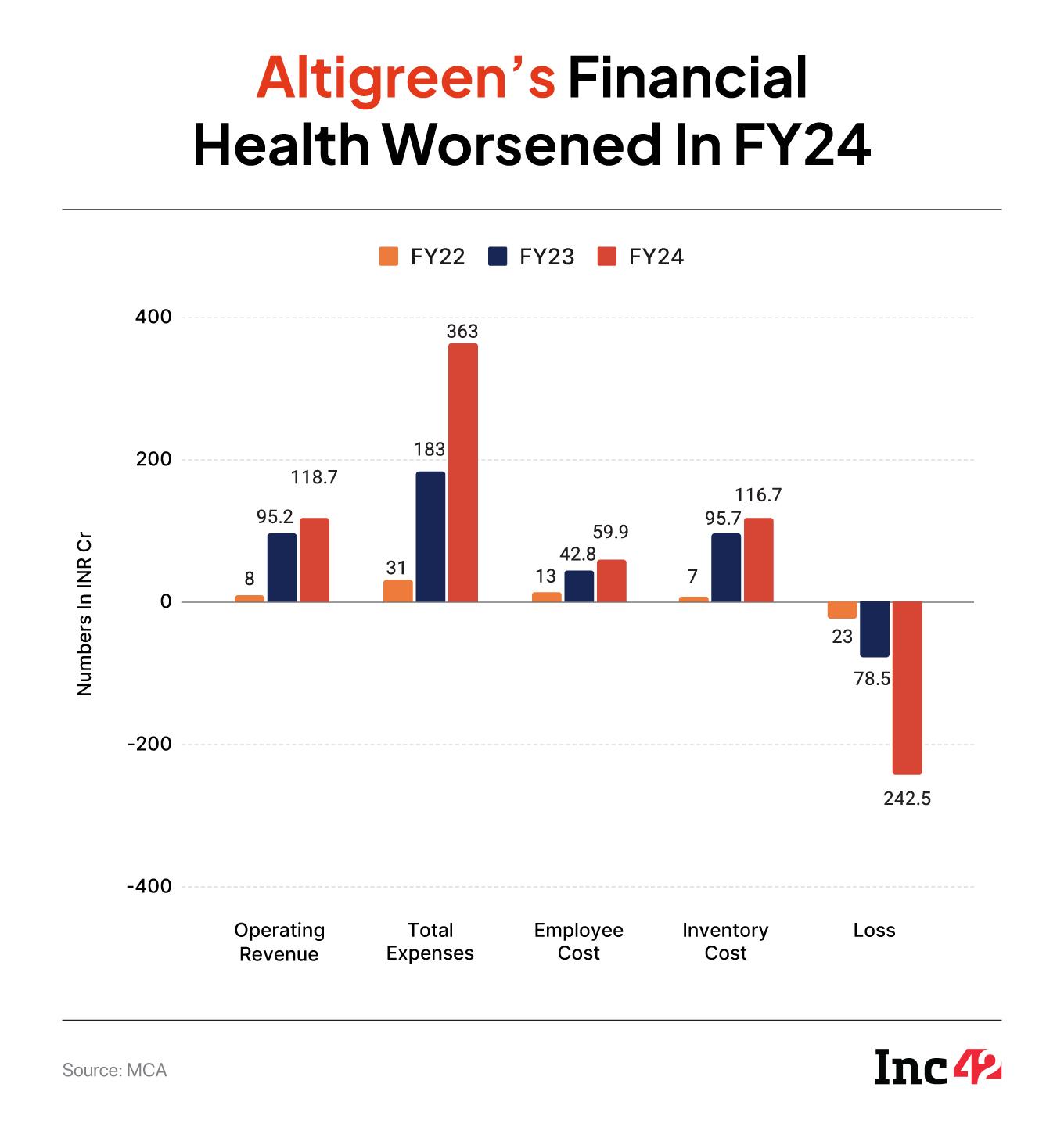

Post the fundraise, the startup increased its employee headcount, doubled down on its manufacturing by increasing the frequency of shifts to ramp up production. The startup went on to launch retail outlets by tying up with local dealers to facilitate easy delivery and servicing. All was going well, but then what happened to the startup?

Ever since the Series A funding, the startup hit the pedal on rapid expansion. The startup scaled its production plant and warehouse and expanded its distribution network. Besides, the startup’s employee count rose by over 3.5X to over 350.

However, problems started brewing in 2023, exactly a year after its Series A funding, thrusting Altigreen into the spotlight.

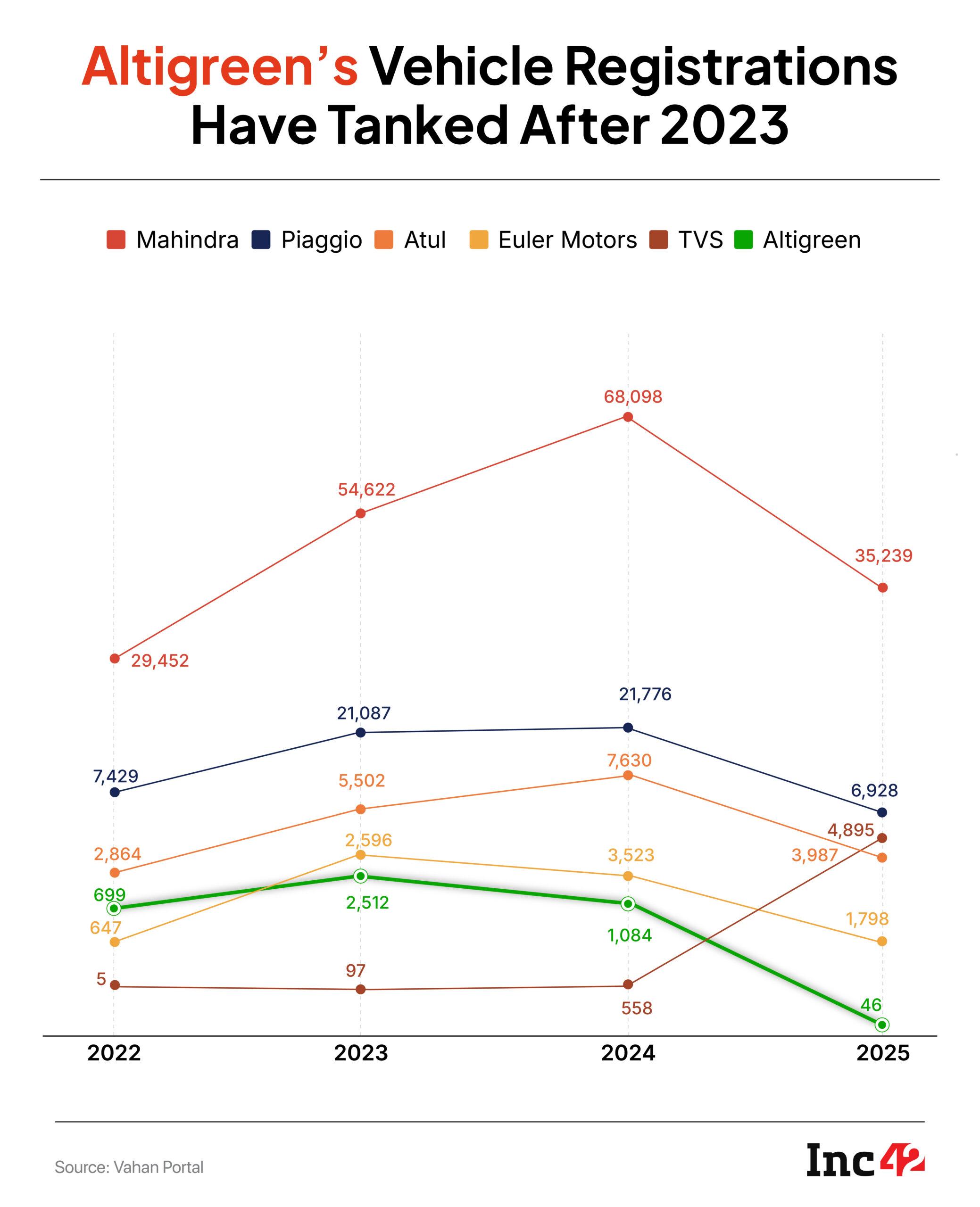

…And Where It EndedThe first big problem was that Altigreen’s anticipated demand for its vehicles was met with an underwhelming response in the market. Those who worked with the company claim that the big problem was that legacy automobile OEMs introduced electric three-wheelers with more advanced technology and superior distribution.

This led to a spurt in EV adoption for hyperlocal deliveries, but Altigreen did not rise with the tide.

One reason for this could be that the startup’s production quality was not up to the market standards. One Altigreen dealer, requesting anonymity, said that within three months of purchase, the majority of Altigreen vehicles were hit with operational issues.

Despite this criticism, Altigreen CEO Saran believes that there was always demand for the company’s three-wheelers and dismissed issues with the production quality.

“Changes in certification standards in 2022 & 2023, and the abrupt swings in EV subsidies did cause hiccups in the EV adoptions across India. Altigreen focussed on ensuring positive margins on its EVs through deep value engineering instead of market share in a nascent EV industry. We had 5,000 Altigreen 3Ws plying in over 120 cities and towns of India, having cumulatively covered over 130 Mn km. This is a strong testament to the quality standards we follow,” the CEO told Inc42.

Saran added that B2B and B2C customers continue to appreciate the quality of Altigreen’s vehicles and the homegrown EV hardware and software stack.

In an attempt to venture into the passenger vehicles category, Saran said that Altigreen built prototypes of small passenger vehicles, large cargo three-wheelers and electric four-wheeler LCVs (light commercial vehicles). But this bet did not pay off. A source added that the startup spent a significant amount of its funding on the R&D of passenger vehicles, as the management was certain about the next growth phase for the company coming from this segment.

By 2023, Altigreen was said to be in discussions with investors for a potential $85 Mn fundraise. However the funding didn’t materialise, and by the end of 2023, the startup laid off around 100 employees. The company wanted to raise the funds to venture into the passenger vehicle category.

But its existing three-wheelers were already witnessing underwhelming market demand, and as a result, the company was compelled to scale back production, and it restricted the factory to a single shift from a double shift in 2023.

Without the funding, the startup had to implement salary cuts from the beginning of 2024, even as sales dwindled by almost half. But by the end of 2024, the number of vehicles dispatched from Altigreen’s Malur factory was in the range of 50-90 per month, down from triple-digit figures a year ago.

“We knew there were a lot of dealers in the country who were frustrated with the unsold inventory. They had unsold vehicles for over a year,” said another person aware of the matter, adding that the startup offered to move these unsold vehicles to those dealers where there was demand.

This move further dented the bottom line. In FY24, the startup’s losses jumped 209% YoY to INR 242.5 Cr, but revenue rose merely by 25% YoY to INR 119 Cr.

Vendors allege the sales slowdown means Altigreen is yet to clear pending dues to the tune of crores of rupees.

Altigreen’s CEO acknowledged these overdue payables. “We have been in touch with them and communicated our efforts to raise funds. Most of them are standing with us, realising that even large companies (leave alone startups like Altigreen, which have been an OEM for just 3.5 years) can go through fund crunch situations,” Saran added.

Even as these problems persist, reports about a potential infusion into Altigreen are routine. It was reported to be in advanced talks with Hero Motors for a possible fund raise of INR 900 Cr ($103 Mn).

This move was hailed as Hero’s entry into the three-wheeler segment. The top management assured employees that Hero’s infusion would allow the company to ramp up production. But this failed to materialise. Then, in March 2025, Hero announced that it would acquire a 32.1% stake for INR 628 Cr ($72 Mn) in Altigreen’s competitor – Euler Motors. And, we have yet to witness how it unfolds.

While the majority of the workforce left Altigreen by the end of 2024, with no respite in sight for the unpaid salaries, some did stay back, hoping that things will come back to life.

From around 350-400 employees in 2022, today the company has around 130-140 employees, and not many are expected to continue beyond the next few months.

“We were loyal to this organisation. We wanted it to revive. We are in a dilemma, if we quit now, our six months’ salary will perish, if we don’t, we don’t know how to meet our end,” said another employee.

Earlier this year, the startup was in conversation with automobile conglomerate JBM Group for a potential capital infusion. People aware of the development said that the JBM team, including the senior leadership team, visited Altigreen’s manufacturing plant several times.

However, again at a company-wide town hall at the end of May, the management said that the time taken to materialise the deal with JBM is taking too long, hence the startup has started conversations with a Middle Eastern firm for a capital infusion.

When asked about the startup’s potential funding development and the past failure in securing the investment, Saran told Inc42, “As part of our fundraise, Altigreen has engaged with many types of investors, including entities of the automotive industry – OEMs, tier 1 suppliers and mobility-as-a-service (MaaS) operators. We are bound by confidentiality and will not be able to confirm or deny any names or our interactions with them.”

However, he did say that the startup is in the middle of raising $35 Mn in a Series B round. Saran did not mention who the potential investors would be. It’s also not clear how much of this would go towards settling employee salaries and clearing vendor dues.

To revive its sales machine, Altigreen will need to invest heavily in hiring, restarting production, marketing and more importantly, regain the trust of dealers following previous setbacks.

Plus, this time around, it will not have the early mover advantage that helped it gain traction in the early days. As the EV ecosystem matures, deep-pocketed players such as Mahindra, TVS, Piaggio, Bajaj and even startups like Euler Motors have looked to bank on three wheelers for growth. Altigreen paved the path for this adoption, but now it’s left playing second fiddle in the market.

Edited By Nikhil Subramaniam

The post Reliance-Backed Altigreen’s EV Three-Wheeler Dreams Hit A Wall appeared first on Inc42 Media.

You may also like

I am not going to Rajya Sabha, says Kejriwal

Noshir Gowadia: Indian-origin engineer developed propulsion system of US B-2 Spirit bombers; jailed for 32 years for helping China build cruise missile

Morning news wrap: Trump announces end of Israel-Iran conflict; Axiom mission scheduled to launch on June 25; & more

Ali Fazal: Working with Anurag Basu is like stepping into a musical dreamscape

Smartphone Tips: Which tempered glass should you get installed on your phone? Know those things that even shopkeepers don't tell you..